Fortune Brands Announces $250 Million Share Repurchase Authorization

Fortune Brands continues to act on its strategy for utilizing free cash

flow and the balance sheet to drive incremental shareholder value, as

evidenced by the approximately

-

Complete acquisitions of Sentry Safe and WoodCrafters, totaling

$417 million . -

Opportunistically repurchase

$463 million in Company shares. -

Initiate a

$0.10 quarterly dividend and increase the dividend to$0.12 .

With approximately

"We have deployed approximately

The newly announced share repurchase authorization does not obligate the

Company to repurchase any dollar amount or number of shares of common

stock. This authorization is in effect until

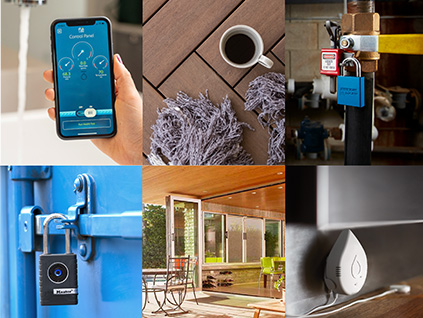

About Fortune Brands

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains certain "forward-looking statements"

regarding business strategies, market potential, future financial

performance and other matters. Future or conditional verbs such as

"will," "estimate" and "may" are generally forward-looking in nature and

not historical facts. Where, in any forward-looking statement, we

express an expectation or belief as to future results or events, such

expectation or belief is based on the current plans and expectations of

our management. Although we believe that these statements are based on

reasonable assumptions, they are subject to numerous factors, risks and

uncertainties that could cause actual outcomes and results to be

materially different from those indicated in such statements. Our actual

results could differ materially from the results contemplated by these

forward-looking statements due to a number of factors, including but not

limited to: (i) our reliance on the North American home improvement,

repair and new home construction activity levels, (ii) the North

American and global economies, (iii) risk associated with entering into

potential strategic acquisitions and integrating acquired companies,

(iv) our ability to remain innovative and protect our intellectual

property, (v) our reliance on key customers and suppliers, (vi) the cost

and availability associated with our supply chains and the availability

of raw materials, (vii) risk of increases in our postretirement

benefit-related costs and funding requirements, (viii) compliance with

tax, environmental and federal, state, and international laws and

industry regulatory standards, and (ix) the risk of doing business

internationally. These and other factors are discussed in Item 1A of our

Annual Report on Form 10-K for the year ended

Investor and Media Contact:

brian.lantz@FBHS.com

Source:

News Provided by Acquire Media