Fortune Brands Significantly Expands Margin in the Third Quarter; Executes on Focused Set of Strategic Priorities Amidst a Challenging Environment

Highlights:

- Q3 2024 sales were

$1.2 billion , a decrease of 8 percent versus Q3 2023; organic sales excluding the impact of China were down 5 percent - Q3 2024 earnings per share (EPS) were

$1.09 , an increase of 2 percent versus a year ago; EPS before charges / gains were$1.16 , a decrease of 3 percent versus Q3 2023 - Company updates full-year 2024 guidance to reflect current market conditions and impact of recent hurricanes

“Our teams continued to execute in a very dynamic market. We again delivered margin expansion despite the unfavorable macroeconomic environment,” said Fortune Brands Chief Executive Officer

Fink continued, “We remain fully confident in our strategy, and have taken action to be a leaner and more agile company while continuing to invest in our highest-growth opportunities. Fortune Brands is well positioned for future growth.”

Third Quarter 2024 Results

($ in millions, except per share amounts)

Unaudited

Total Company Results

| Reported | Operating Income | Operating Margin | EPS |

Q3 2024 GAAP | 17.8% | |||

Change | (8%) | 4% | 220 bps | 2% |

| Reported | Operating Income | Operating Margin | EPS |

Q3 2024 Non-GAAP | 18.7% | |||

Change | (8%) | (2%) | 130 bps | (3%) |

Segment Results

| Change | Operating Margin | Change | Operating Margin | Change | |||

Reported | Organic | Reported | Organic | |||||

Water Innovations | (8%) | (7%) | 23.8% | (10) bps | 24.6% | 40 bps | ||

Outdoors | (6%) | (6%) | 16.9% | 270 bps | 18.0% | 320 bps | ||

Security | (14%) | (12%) | 18.6% | 1,040 bps | 19.3% | 250 bps | ||

Balance Sheet and Cash Flow

The Company exited the quarter with a strong balance sheet, and generated

As of the end of the third quarter 2024:

Net debt | |

Net debt to EBITDA before charges / gains | 2.5x |

Cash | |

Amount available under revolving credit facility |

2024 Market and Financial Guidance

“We focused on executing our strategic priorities and delivered strong margin results in a soft environment. We are updating our full-year 2024 guidance to reflect current market conditions, which include lower POS performance, incremental channel destocking and short-term impacts from recent hurricanes,” said Fortune Brands Chief Financial Officer

Updated 2024 Full-Year Guidance

Prior 2024 Full-Year Guidance | Updated 2024 Full-Year Guidance | |

MARKET | ||

Global market | -3% to -1% | -3.5% to -1.5% |

U.S. market | -1% to flat | -1% to flat |

-4% to -3% | -4% to -3% | |

8% to 10% | 7% to 9% | |

China market | -20% to -15% | -20% to -15% |

TOTAL COMPANY FINANCIAL METRICS | ||

Net sales | 2.5% to 4.5% | Flat to 1% |

Net sales [organic] | -2% to flat | -4.5% to -3.5% |

Operating margin before charges / gains | 17.0% to 17.5% | 17.0% to 17.25% |

EPS before charges / gains | ||

Cash flow from operations | Around | Around |

Free cash flow | Around | Around |

Cash conversion | Around 100% | Around 100% |

SEGMENT FINANCIAL METRICS | ||

Water Innovations net sales | 2.5% to 4.5% | 1% to 1.5% |

Water Innovations net sales [organic] | -4% to -2% | -5% to -4.5% |

Water Innovations operating margin before charges / gains | Around 24% | Around 23.5% |

Outdoors net sales | 2% to 4% | Flat to 1% |

Outdoors operating margin before charges / gains | 14.5% to 15.5% | 16.0% to 16.5% |

Security net sales | 5% to 7% | -2% to -1% |

Security net sales [organic] | -3% to -1% | -10% to -9% |

Security operating margin before charges / gains | 15.5% to 16.5% | 16.5% to 17.0% |

OTHER ITEMS | ||

Corporate expense | ||

Interest expense | ||

Other income / (expense) | Around | Around |

Capex | Around | Around |

Tax rate | 23.25% to 23.5% | 22.25% to 22.5% |

Share count | Around 126 million | Around 126 million |

For certain forward-looking non-GAAP measures (as used in this press release, operating margin before charges / gains on a full Company and segment basis, EPS before charges / gains and cash conversion), the Company is unable to provide a reconciliation to the most comparable GAAP financial measure because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing and / or amount of various items that have not yet occurred, including the high variability and low visibility with respect to gains and losses associated with our defined benefit plans, which are excluded from EPS before charges / gains and cash conversion, and restructuring and other charges, which are excluded from operating margin before charges / gains, EPS before charges / gains and cash conversion. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions.

Conference Call Details

Today at

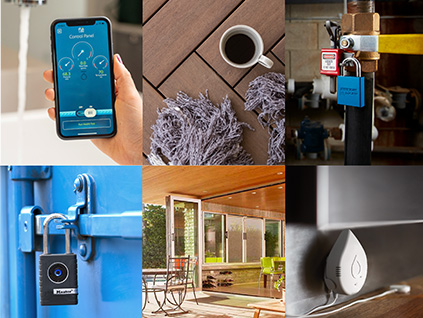

About Fortune Brands Innovations

The Company is a brand, innovation and channel leader focused on exciting, supercharged categories in the home products, security and commercial building markets. The Company’s portfolio of brands includes Moen,

Fortune Brands is headquartered in

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief or expectations for our business, operations, financial performance or financial condition in addition to statements regarding our expectations for the markets in which we operate, general business strategies, the market potential of our brands, trends in the housing market, the potential impact of costs, including material and labor costs, the potential impact of inflation, expected capital spending, expected pension contributions or de-risking initiatives, the expected impact of acquisitions, dispositions and other strategic transactions, the anticipated impact of recently issued accounting standards on our financial statements, and other matters that are not historical in nature. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “outlook,” “positioned,” "confident," "opportunity," "focus" and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on current expectations, estimates, assumptions and projections of our management about our industry, business and future financial results, available at the time this press release is issued. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements, including but not limited to: (i) our reliance on the North American and Chinese home improvement, repair and remodel and new home construction activity levels, (ii) the housing market, downward changes in the general economy, unfavorable interest rates or other business conditions, (iii) the competitive nature of consumer and trade brand businesses, (iv) our ability to execute on our strategic plans and the effectiveness of our strategies in the face of business competition, (v) our reliance on key customers and suppliers, including wholesale distributors and dealers and retailers, (vi) risks relating to rapidly evolving technological change, (vii) risks associated with our ability to improve organizational productivity and global supply chain efficiency and flexibility, (viii) risks associated with global commodity and energy availability and price volatility, as well as the possibility of sustained inflation, (ix) delays or outages in our information technology systems or computer networks or breaches of our information technology systems or other cybersecurity incidents, (x) risks associated with doing business globally, including changes in trade-related tariffs and risks with uncertain trade environments, (xi) risks associated with the disruption of operations, including as a result of severe weather events, (xii) our inability to obtain raw materials and finished goods in a timely and cost-effective manner, (xiii) risks associated with strategic acquisitions, divestitures and joint ventures, including difficulties integrating acquired companies and the inability to achieve the expected financial results and benefits of transactions, (xiv) impairments in the carrying value of goodwill or other acquired intangible assets, (xv) risks of increases in our defined benefit-related costs and funding requirements, (xvi) our ability to attract and retain qualified personnel and other labor constraints, (xvii) the effect of climate change and the impact of related changes in government regulations and consumer preferences, (xviii) risks associated with environmental, social and governance matters, (xix) potential liabilities and costs from claims and litigation, (xx) changes in government and industry regulatory standards, (xxi) future tax law changes or the interpretation of existing tax laws, (xxii) our ability to secure and protect our intellectual property rights, and (xxiii) the impact of COVID-19 on the business. These and other factors are discussed in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K for the year ended

Use of Non-GAAP Financial Information

This press release includes measures not derived in accordance with generally accepted accounting principles (“GAAP”), such as diluted earnings per share before charges / gains, operating income before charges / gains, operating margin before charges / gains, net debt, net debt to EBITDA before charges / gains, sales excluding the impact of acquisitions (organic sales), organic sales excluding the impact of China, free cash flow and cash conversion. These non-GAAP measures should not be considered in isolation or as a substitute for any measure derived in accordance with GAAP and may also be inconsistent with similar measures presented by other companies. Reconciliations of these measures to the applicable most closely comparable GAAP measures, and reasons for the Company’s use of these measures, are presented in the attached pages.

FORTUNE BRANDS INNOVATIONS, INC. (In millions) (Unaudited) | ||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||

|

| Thirteen Weeks Ended |

|

|

| Thirty-Nine Weeks Ended |

|

| ||||||||||||||||||

Net sales (GAAP) |

| $ Change | % Change |

| $ Change | % Change | ||||||||||||||||||||

Water |

| $ | 635.1 |

| $ | 688.0 |

| $ | (52.9 | ) |

| (8 | ) |

| $ | 1,920.0 |

| $ | 1,899.2 |

| $ | 20.8 |

|

| 1 |

|

Outdoors |

|

| 342.7 |

|

| 366.4 |

|

| (23.7 | ) |

| (6 | ) |

|

| 1,047.1 |

|

| 1,031.9 |

|

| 15.2 |

|

| 2 |

|

Security |

|

| 177.5 |

|

| 206.8 |

|

| (29.3 | ) |

| (14 | ) |

|

| 537.7 |

|

| 533.8 |

|

| 3.9 |

|

| 1 |

|

Total net sales |

| $ | 1,155.3 |

| $ | 1,261.2 |

| $ | (105.9 | ) |

| (8 | ) |

| $ | 3,504.8 |

| $ | 3,464.9 |

| $ | 39.9 |

|

| 1 |

|

RECONCILIATIONS OF GAAP OPERATING INCOME TO OPERATING INCOME BEFORE CHARGES/GAINS (In millions) (Unaudited) | ||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||

|

| Thirteen Weeks Ended |

|

|

| Thirty-Nine Weeks Ended |

|

| ||||||||||||||||||

|

| $ Change | % Change |

| $ Change | % Change | ||||||||||||||||||||

WATER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Operating income (GAAP) |

| $ | 151.4 |

| $ | 164.2 |

| $ | (12.8 | ) |

| (8 | ) |

| $ | 443.6 |

| $ | 434.7 |

| $ | 8.9 |

|

| 2 |

|

Restructuring charges |

|

| 3.4 |

|

| - |

|

| 3.4 |

|

| 100 |

|

|

| 4.9 |

|

| 1.3 |

|

| 3.6 |

|

| 277 |

|

Other charges/(gains) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cost of products sold |

|

| 1.6 |

|

| 0.1 |

|

| 1.5 |

|

| 1,500 |

|

|

| 2.4 |

|

| 0.3 |

|

| 2.1 |

|

| 700 |

|

Amortization of inventory step-up (f) |

|

| - |

|

| 2.0 |

|

| (2.0 | ) |

| (100 | ) |

|

| 0.3 |

|

| 2.0 |

|

| (1.7 | ) |

| (85 | ) |

Operating income before charges/gains (a) |

| $ | 156.4 |

| $ | 166.3 |

| $ | (9.9 | ) |

| (6 | ) |

| $ | 451.2 |

| $ | 438.3 |

| $ | 12.9 |

|

| 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

OUTDOORS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Operating income (GAAP) |

| $ | 57.8 |

| $ | 52.0 |

| $ | 5.8 |

|

| 11 |

|

| $ | 143.9 |

| $ | 126.2 |

| $ | 17.7 |

|

| 14 |

|

Restructuring charges |

|

| 2.4 |

|

| - |

|

| 2.4 |

|

| 100 |

|

|

| 4.9 |

|

| 3.1 |

|

| 1.8 |

|

| 58 |

|

Other charges/(gains) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cost of products sold |

|

| 1.4 |

|

| 1.4 |

|

| - |

|

| - |

|

|

| 13.8 |

|

| (0.4 | ) |

| 14.2 |

|

| (3,550 | ) |

Selling, general and administrative expenses |

|

| - |

|

| 0.1 |

|

| (0.1 | ) |

| (100 | ) |

|

| - |

|

| - |

|

| - |

|

| - |

|

Solar compensation (e) |

|

| - |

|

| 0.8 |

|

| (0.8 | ) |

| (100 | ) |

|

| 0.2 |

|

| 2.1 |

|

| (1.9 | ) |

| (90 | ) |

Asset impairment charge |

|

| - |

|

| - |

|

| - |

|

| - |

|

|

| - |

|

| - |

|

| - |

|

| - |

|

Operating income before charges/gains (a) |

|

| 61.6 |

|

| 54.3 |

| $ | 7.3 |

|

| 13 |

|

| 162.8 |

|

| 131.0 |

| $ | 31.8 |

|

| 24 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

SECURITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Operating income (GAAP) |

| $ | 33.0 |

| $ | 17.0 |

| $ | 16.0 |

|

| 94 |

|

| $ | 86.5 |

| $ | 37.8 |

| $ | 48.7 |

|

| 129 |

|

Restructuring charges |

|

| 0.8 |

|

| 3.7 |

|

| (2.9 | ) |

| (78 | ) |

|

| 3.1 |

|

| 23.8 |

|

| (20.7 | ) |

| (87 | ) |

Other charges/(gains) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cost of products sold |

|

| 0.5 |

|

| 5.1 |

|

| (4.6 | ) |

| (90 | ) |

|

| 7.7 |

|

| 12.7 |

|

| (5.0 | ) |

| (39 | ) |

Amortization of inventory step-up (f) |

|

| - |

|

| 8.9 |

|

| (8.9 | ) |

| (100 | ) |

|

| - |

|

| 8.9 |

|

| (8.9 | ) |

| (100 | ) |

Operating income before charges/gains (a) |

| $ | 34.3 |

| $ | 34.7 |

| $ | (0.4 | ) |

| (1 | ) |

| $ | 97.3 |

| $ | 83.2 |

| $ | 14.1 |

|

| 17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

CORPORATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Corporate expense (GAAP) |

| $ | (37.1 | ) | $ | (36.7 | ) | $ | 0.4 |

|

| 1 |

|

| $ | (114.4 | ) | $ | (117.7 | ) | $ | (3.3 | ) |

| (3 | ) |

Restructuring charges |

|

| 0.8 |

|

| - |

|

| (0.8 | ) |

| (100 | ) |

|

| 1.2 |

|

| 0.7 |

|

| (0.5 | ) |

| (71 | ) |

Other charges/(gains) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Selling, general and administrative expenses |

|

| - |

|

| 0.1 |

|

| 0.1 |

|

| 100 |

|

|

| - |

|

| 0.2 |

|

| 0.2 |

|

| 100 |

|

ASSA transaction expenses (d) |

|

| (0.1 | ) |

| 1.2 |

|

| 1.3 |

|

| 108 |

|

|

| 1.0 |

|

| 18.7 |

|

| 17.7 |

|

| 95 |

|

General and administrative expenses before charges/gains (a) |

| $ | (36.4 | ) | $ | (35.4 | ) | $ | 1.0 |

|

| 3 |

|

| $ | (112.2 | ) | $ | (98.1 | ) | $ | 14.1 |

|

| 14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

TOTAL COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Operating income (GAAP) |

| $ | 205.1 |

| $ | 196.5 |

| $ | 8.6 |

|

| 4 |

|

| $ | 559.6 |

| $ | 481.0 |

| $ | 78.6 |

|

| 16 |

|

Restructuring charges |

|

| 7.4 |

|

| 3.7 |

|

| 3.7 |

|

| 100 |

|

|

| 14.1 |

|

| 28.9 |

|

| (14.8 | ) |

| (51 | ) |

Other charges/(gains) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cost of products sold |

|

| 3.5 |

|

| 6.6 |

|

| (3.1 | ) |

| (47 | ) |

|

| 23.9 |

|

| 12.6 |

|

| 11.3 |

|

| 90 |

|

Selling, general and administrative expenses |

|

| - |

|

| 0.2 |

|

| (0.2 | ) |

| (100 | ) |

|

| - |

|

| 0.2 |

|

| (0.2 | ) |

| (100 | ) |

Solar compensation (e) |

|

| - |

|

| 0.8 |

|

| (0.8 | ) |

| (100 | ) |

|

| 0.2 |

|

| 2.1 |

|

| (1.9 | ) |

| (90 | ) |

ASSA transaction expenses (d) |

|

| (0.1 | ) |

| 1.2 |

|

| (1.3 | ) |

| (108 | ) |

|

| 1.0 |

|

| 18.7 |

|

| (17.7 | ) |

| (95 | ) |

Amortization of inventory step-up (f) |

|

| - |

|

| 10.9 |

|

| (10.9 | ) |

| (100 | ) |

|

| 0.3 |

|

| 10.9 |

|

| (10.6 | ) |

| (97 | ) |

Operating income before charges/gains (a) |

| $ | 215.9 |

| $ | 219.9 |

| $ | (4.0 | ) |

| (2 | ) |

| $ | 599.1 |

| $ | 554.4 |

| $ | 44.7 |

|

| 8 |

|

(a) (d) (e) (f) For definitions of Non-GAAP measures, see Definitions of Terms page

FORTUNE BRANDS INNOVATIONS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (GAAP) (In millions) (Unaudited) | ||||||||

|

| |||||||

|

|

|

| |||||

|

|

|

|

|

| |||

Assets |

|

|

|

|

| |||

Current assets |

|

|

|

|

| |||

Cash and cash equivalents | $ | 344.8 |

|

| $ | 366.4 |

| |

Accounts receivable, net |

| 555.9 |

|

|

| 534.2 |

| |

Inventories |

| 962.6 |

|

|

| 982.3 |

| |

Other current assets |

| 155.8 |

|

|

| 162.8 |

| |

Total current assets |

| 2,019.1 |

|

|

| 2,045.7 |

| |

|

|

|

|

|

| |||

Property, plant and equipment, net |

| 981.6 |

|

|

| 975.0 |

| |

| 2,004.7 |

|

|

| 1,906.8 |

| ||

Other intangible assets, net of accumulated amortization |

| 1,324.3 |

|

|

| 1,354.7 |

| |

Other assets |

| 268.7 |

|

|

| 282.8 |

| |

Total assets | $ | 6,598.4 |

|

| $ | 6,565.0 |

| |

|

|

|

|

|

| |||

|

|

|

|

|

| |||

Liabilities and equity |

|

|

|

|

| |||

Current liabilities |

|

|

|

|

| |||

Short-term debt | $ | 499.5 |

|

| $ | - |

| |

Accounts payable |

| 493.3 |

|

|

| 568.1 |

| |

Other current liabilities |

| 539.4 |

|

|

| 632.3 |

| |

Total current liabilities |

| 1,532.2 |

|

|

| 1,200.4 |

| |

|

|

|

|

|

| |||

Long-term debt |

| 2,277.8 |

|

|

| 2,670.1 |

| |

Deferred income taxes |

| 126.2 |

|

|

| 111.3 |

| |

Other non-current liabilities |

| 266.3 |

|

|

| 289.8 |

| |

Total liabilities |

| 4,202.5 |

|

|

| 4,271.6 |

| |

|

|

|

|

|

| |||

Stockholders' equity |

| 2,395.9 |

|

|

| 2,293.4 |

| |

Total equity |

| 2,395.9 |

|

|

| 2,293.4 |

| |

Total liabilities and equity | $ | 6,598.4 |

|

| $ | 6,565.0 |

| |

FORTUNE BRANDS INNOVATIONS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) | |||||||

|

| Thirty-Nine Weeks Ended | |||||

|

| ||||||

Operating activities |

|

|

|

|

| ||

Net income |

| $ | 366.8 |

| $ | 323.2 |

|

Depreciation and amortization |

|

| 147.4 |

|

| 111.5 |

|

Non-cash lease expense |

|

| 29.3 |

|

| 23.9 |

|

Deferred taxes |

|

| 18.1 |

|

| (11.5 | ) |

Other non-cash items |

|

| 30.7 |

|

| 24.9 |

|

Changes in assets and liabilities, net |

|

| (196.8 | ) |

| 363.6 |

|

Net cash provided by operating activities |

| $ | 395.5 |

| $ | 835.6 |

|

Investing activities |

|

|

|

|

| ||

Capital expenditures |

| $ | (133.1 | ) | $ | (175.7 | ) |

Proceeds from the disposition of assets |

|

| 6.8 |

|

| 2.8 |

|

Cost of acquisitions, net of cash acquired |

|

| (129.0 | ) |

| (784.1 | ) |

Other investing activities, net |

|

| (3.4 | ) |

| - |

|

Net cash used in investing activities |

| $ | (258.7 | ) | $ | (957.0 | ) |

Financing activities |

|

|

|

|

| ||

Increase in debt, net |

| $ | 105.0 |

| $ | 155.1 |

|

Proceeds from the exercise of stock options |

|

| 10.4 |

|

| 8.8 |

|

|

| (190.4 | ) |

| (120.1 | ) | |

Dividends to stockholders |

|

| (90.0 | ) |

| (87.8 | ) |

Other items, net |

|

| (18.1 | ) |

| (16.6 | ) |

Net cash provided by financing activities |

| $ | (183.1 | ) | $ | (60.6 | ) |

|

|

|

|

|

| ||

Effect of foreign exchange rate changes on cash |

| $ | 0.8 |

| $ | (7.7 | ) |

|

|

|

|

|

| ||

Net increase (decrease) in cash and cash equivalents |

| $ | (45.5 | ) | $ | (189.7 | ) |

Cash, cash equivalents and restricted cash* at beginning of period |

|

| 395.5 |

|

| 648.3 |

|

Cash, cash equivalents and restricted cash* at end of period |

| $ | 350.0 |

| $ | 458.6 |

|

FREE CASH FLOW |

| Thirty-Nine Weeks Ended | 2024 Full Year | |||||||

|

| Estimate | ||||||||

|

|

|

|

|

|

|

| |||

Cash flow from operations (GAAP) |

| $ | 395.5 |

| $ | 835.6 |

| $ | 650.0 |

|

Less: |

|

|

|

|

|

|

| |||

Capital expenditures |

| $ | 133.1 |

| $ | 175.7 |

| $ | 175.0 |

|

Free cash flow** |

| $ | 262.4 |

| $ | 659.9 |

| $ | 475.0 |

|

*Restricted cash of

** Free cash flow is cash flow from operations calculated in accordance with

FORTUNE BRANDS INNOVATIONS, INC. CASH FLOW FROM OPERATIONS (GAAP) TO FREE CASH FLOW (In millions) (Unaudited) | ||||

|

| |||

| Thirteen Weeks Ended | |||

| ||||

|

|

|

| |

|

|

| ||

Cash flow from operations (GAAP) | $ | 205.3 |

| |

Less: |

|

| ||

Capital expenditures |

| 29.7 |

| |

Free cash flow* | $ | 175.6 |

| |

* Free cash flow is cash flow from operations calculated in accordance with

FORTUNE BRANDS INNOVATIONS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (GAAP) (In millions, except per share amounts) (Unaudited) | ||||||||||||||||||||

|

| |||||||||||||||||||

| Thirteen Weeks Ended |

|

| Thirty-Nine Weeks Ended |

| |||||||||||||||

| % Change |

| % Change | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net sales | $ | 1,155.3 |

| $ | 1,261.2 |

|

| (8 | ) |

| $ | 3,504.8 |

| $ | 3,464.9 |

|

| 1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Cost of products sold |

| 625.5 |

|

| 721.1 |

|

| (13 | ) |

|

| 1,946.4 |

|

| 2,048.4 |

|

| (5 | ) | |

Selling, general and administrative expenses |

| 298.2 |

|

| 321.1 |

|

| (7 | ) |

|

| 929.5 |

|

| 862.6 |

|

| 8 |

| |

Amortization of intangible assets |

| 19.1 |

|

| 18.8 |

|

| 2 |

|

|

| 55.2 |

|

| 44.0 |

|

| 25 |

| |

Restructuring charges |

| 7.4 |

|

| 3.7 |

|

| 100 |

|

|

| 14.1 |

|

| 28.9 |

|

| (51 | ) | |

Operating income |

| 205.1 |

|

| 196.5 |

|

| 4 |

|

|

| 559.6 |

|

| 481.0 |

|

| 16 |

| |

Interest expense |

| 30.2 |

|

| 33.3 |

|

| (9 | ) |

|

| 92.6 |

|

| 87.9 |

|

| 5 |

| |

Other (income)/expense, net |

| (1.6 | ) |

| (9.4 | ) |

| (83 | ) |

|

| (5.2 | ) |

| (20.9 | ) |

| (75 | ) | |

Income from continuing operations before taxes |

| 176.5 |

|

| 172.6 |

|

| 2 |

|

|

| 472.2 |

|

| 414.0 |

|

| 14 |

| |

Income tax |

| 39.9 |

|

| 36.1 |

|

| 11 |

|

|

| 105.4 |

|

| 89.8 |

|

| 17 |

| |

Income from continuing operations, net of tax | $ | 136.6 |

| $ | 136.5 |

|

| - |

|

| $ | 366.8 |

| $ | 324.2 |

|

| 13 |

| |

Loss from discontinued operations, net of tax |

| - |

|

| - |

|

| - |

|

|

| - |

|

| (1.0 | ) |

| (100 | ) | |

Net income | $ | 136.6 |

| $ | 136.5 |

|

| - |

|

| $ | 366.8 |

| $ | 323.2 |

|

| 13 |

| |

Net income attributable to Fortune Brands | $ | 136.6 |

| $ | 136.5 |

|

| - |

|

| $ | 366.8 |

| $ | 323.2 |

|

| 13 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Diluted earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Continuing operations | $ | 1.09 |

| $ | 1.07 |

|

| 2 |

|

| $ | 2.91 |

| $ | 2.53 |

|

| 15 |

| |

Discontinued operations | $ | - |

| $ | - |

|

| - |

|

| $ | - |

| $ | - |

|

| - |

| |

Diluted EPS attributable to Fortune Brands | $ | 1.09 |

| $ | 1.07 |

|

| 2 |

|

| $ | 2.91 |

| $ | 2.53 |

|

| 15 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Diluted average number of shares outstanding |

| 125.1 |

|

| 127.8 |

|

| (2 | ) |

|

| 126.0 |

|

| 127.9 |

|

| (1 | ) | |

FORTUNE BRANDS INNOVATIONS, INC. (In millions) (Unaudited) | ||||||||||||||||||||

RECONCILIATIONS OF INCOME FROM CONTINUING OPERATIONS, NET OF TAX TO EBITDA BEFORE CHARGES/GAINS | ||||||||||||||||||||

|

| |||||||||||||||||||

| Thirteen Weeks Ended |

|

| Thirty-Nine Weeks Ended |

| |||||||||||||||

| % Change |

| % Change | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Income from continuing operations, net of tax | $ | 136.6 |

| $ | 136.5 |

|

| - |

|

| $ | 366.8 |

| $ | 324.2 |

|

| 13 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Depreciation * | $ | 22.7 |

| $ | 21.0 |

|

| 8 |

|

| $ | 69.6 |

| $ | 59.6 |

|

| 17 |

| |

Amortization of intangible assets |

| 19.1 |

|

| 18.8 |

|

| 2 |

|

|

| 55.2 |

|

| 44.0 |

|

| 25 |

| |

Restructuring charges |

| 7.4 |

|

| 3.7 |

|

| 100 |

|

|

| 14.1 |

|

| 28.9 |

|

| (51 | ) | |

Other charges/(gains) |

| 3.5 |

|

| 6.8 |

|

| (49 | ) |

|

| 23.9 |

|

| 12.8 |

|

| 87 |

| |

ASSA transaction expenses (d) |

| (0.1 | ) |

| 1.2 |

|

| (108 | ) |

|

| 1.0 |

|

| 18.7 |

|

| (95 | ) | |

Solar compensation (e) |

| - |

|

| 0.8 |

|

| (100 | ) |

|

| 0.2 |

|

| 2.1 |

|

| (90 | ) | |

Amortization of inventory step-up (f) |

| - |

|

| 10.9 |

|

| (100 | ) |

|

| 0.3 |

|

| 10.9 |

|

| (97 | ) | |

Interest expense |

| 30.2 |

|

| 33.3 |

|

| (9 | ) |

|

| 92.6 |

|

| 87.9 |

|

| 5 |

| |

Defined benefit plan actuarial gains/(losses) |

| (0.3 | ) |

| (2.4 | ) |

| (88 | ) |

|

| (0.3 | ) |

| (2.4 | ) |

| (88 | ) | |

Income taxes |

| 39.9 |

|

| 36.1 |

|

| 11 |

|

|

| 105.4 |

|

| 89.8 |

|

| 17 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

EBITDA before charges/gains (c) | $ | 259.0 |

| $ | 266.7 |

|

| (3 | ) |

| $ | 728.8 |

| $ | 676.5 |

|

| 8 |

| |

* Depreciation excludes accelerated depreciation expense of

CALCULATION OF NET DEBT-TO-EBITDA BEFORE CHARGES/GAINS RATIO | ||||

As of |

| |||

Short-term debt ** | $ | 499.5 | ||

Long-term debt ** |

| 2,277.8 | ||

Total debt |

| 2,777.3 | ||

Less: |

| |||

Cash and cash equivalents ** |

| 344.8 | ||

Net debt (1) | $ | 2,432.5 | ||

Fifty-two weeks ended |

| |||

EBITDA before charges/gains (2) (c) | $ | 961.8 | ||

|

| |||

Net debt-to-EBITDA before charges/gains ratio (1/2) |

| 2.5 | ||

** Amounts are per the Unaudited Condensed Consolidated Balance Sheet as of

| Thirteen Weeks Ended | Thirty-Nine Weeks Ended | Fifty-Two Weeks Ended | |||||||

| ||||||||||

|

|

|

|

|

|

| ||||

Income from continuing operations, net of tax | $ | 81.3 |

| $ | 366.8 |

| $ | 448.1 |

| |

|

|

|

|

|

|

| ||||

Depreciation*** | $ | 30.8 |

| $ | 69.6 |

| $ | 100.4 |

| |

Amortization of intangible assets |

| 18.1 |

|

| 55.2 |

|

| 73.3 |

| |

Restructuring charges |

| 3.6 |

|

| 14.1 |

|

| 17.7 |

| |

Other charges/(gains) |

| 9.3 |

|

| 23.9 |

|

| 33.2 |

| |

ASSA transaction expenses (d) |

| 1.1 |

|

| 1.0 |

|

| 2.1 |

| |

Solar compensation (e) |

| 0.6 |

|

| 0.2 |

|

| 0.8 |

| |

Amortization of inventory step-up (f) |

| 1.5 |

|

| 0.3 |

|

| 1.8 |

| |

Interest expense |

| 28.7 |

|

| 92.6 |

|

| 121.3 |

| |

Asset impairment charge (g) |

| 33.5 |

|

| - |

|

| 33.5 |

| |

Defined benefit plan actuarial gains |

| 1.9 |

|

| (0.3 | ) |

| 1.6 |

| |

Income taxes |

| 22.6 |

|

| 105.4 |

|

| 128.0 |

| |

EBITDA before charges/gains (c) | $ | 233.0 |

| $ | 728.8 |

| $ | 961.8 |

| |

*** Depreciation excludes accelerated depreciation expense of

(c) (d) (e) (f) (g) For definitions of Non-GAAP measures, see Definitions of Terms page

RECONCILIATION OF DILUTED EPS FROM CONTINUING OPERATIONS BEFORE CHARGES/GAINS

For the thirteen weeks ended

For the thirty-nine weeks ended

For the thirteen weeks ended

For the thirty-nine weeks ended

| Thirteen Weeks Ended |

|

| Thirty-Nine Weeks Ended |

| |||||||||||||||

| % Change |

| % Change | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Earnings per common share (EPS) - Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Diluted EPS from continuing operations (GAAP) | $ | 1.09 |

| $ | 1.07 |

|

| 2 |

|

| $ | 2.91 |

| $ | 2.53 |

|

| 15 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Restructuring charges |

| 0.05 |

|

| 0.02 |

|

| 150 |

|

|

| 0.09 |

|

| 0.17 |

|

| (47 | ) | |

Other charges/(gains) |

| 0.02 |

|

| 0.03 |

|

| (33 | ) |

|

| 0.15 |

|

| 0.08 |

|

| 88 |

| |

ASSA transaction expenses (d) |

| - |

|

| 0.01 |

|

| (100 | ) |

|

| - |

|

| 0.11 |

|

| (100 | ) | |

Solar compensation (e) |

| - |

|

| - |

|

| - |

|

|

| - |

|

| 0.01 |

|

| (100 | ) | |

Amortization of inventory step-up (f) |

| - |

|

| 0.07 |

|

| (100 | ) |

|

| - |

|

| 0.07 |

|

| (100 | ) | |

Defined benefit plan actuarial (losses)/gains |

| - |

|

| (0.01 | ) |

| (100 | ) |

|

| - |

|

| (0.01 | ) |

| (100 | ) | |

Diluted EPS from continuing operations before charges/gains (b) | $ | 1.16 |

| $ | 1.19 |

|

| (3 | ) |

| $ | 3.15 |

| $ | 2.96 |

|

| 6 |

| |

(b) (d) (e) (f) For definitions of Non-GAAP measures, see Definitions of Terms page

FORTUNE BRANDS INNOVATIONS, INC. (In millions, except per share amounts) (Unaudited) | ||||||||||||||||||||

| Thirteen Weeks Ended |

|

| Thirty-Nine Weeks Ended |

| |||||||||||||||

| % Change |

| % Change | |||||||||||||||||

Net sales (GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Water | $ | 635.1 |

| $ | 688.0 |

|

| (8 | ) |

| $ | 1,920.0 |

| $ | 1,899.2 |

|

| 1 |

| |

Outdoors |

| 342.7 |

|

| 366.4 |

|

| (6 | ) |

|

| 1,047.1 |

|

| 1,031.9 |

|

| 2 |

| |

Security |

| 177.5 |

|

| 206.8 |

|

| (14 | ) |

|

| 537.7 |

|

| 533.8 |

|

| 1 |

| |

Total net sales | $ | 1,155.3 |

| $ | 1,261.2 |

|

| (8 | ) |

| $ | 3,504.8 |

| $ | 3,464.9 |

|

| 1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Water | $ | 151.4 |

| $ | 164.2 |

|

| (8 | ) |

| $ | 443.6 |

| $ | 434.7 |

|

| 2 |

| |

Outdoors |

| 57.8 |

|

| 52.0 |

|

| 11 |

|

|

| 143.9 |

|

| 126.2 |

|

| 14 |

| |

Security |

| 33.0 |

|

| 17.0 |

|

| 94 |

|

|

| 86.5 |

|

| 37.8 |

|

| 129 |

| |

Corporate expenses |

| (37.1 | ) |

| (36.7 | ) |

| 1 |

|

|

| (114.4 | ) |

| (117.7 | ) |

| (3 | ) | |

Total operating income (GAAP) | $ | 205.1 |

| $ | 196.5 |

|

| 4 |

|

| $ | 559.6 |

| $ | 481.0 |

|

| 16 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

OPERATING INCOME BEFORE CHARGES/GAINS RECONCILIATION |

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Total operating income (GAAP) | $ | 205.1 |

| $ | 196.5 |

|

| 4 |

|

| $ | 559.6 |

| $ | 481.0 |

|

| 16 |

| |

Restructuring charges (1) |

| 7.4 |

|

| 3.7 |

|

| 100 |

|

|

| 14.1 |

|

| 28.9 |

|

| (51 | ) | |

Other charges/(gains) (2) |

| 3.5 |

|

| 6.8 |

|

| (49 | ) |

|

| 23.9 |

|

| 12.8 |

|

| 87 |

| |

ASSA transaction expenses (d) |

| (0.1 | ) |

| 1.2 |

|

| (108 | ) |

|

| 1.0 |

|

| 18.7 |

|

| (95 | ) | |

Solar compensation (e) |

| - |

|

| 0.8 |

|

| (100 | ) |

|

| 0.2 |

|

| 2.1 |

|

| (90 | ) | |

Amortization of inventory step-up (f) |

| - |

|

| 10.9 |

|

| (100 | ) |

|

| 0.3 |

|

| 10.9 |

|

| (97 | ) | |

Operating income (loss) before charges/gains (a) | $ | 215.9 |

| $ | 219.9 |

|

| (2 | ) |

| $ | 599.1 |

| $ | 554.4 |

|

| 8 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Water | $ | 156.4 |

| $ | 166.3 |

|

| (6 | ) |

| $ | 451.2 |

| $ | 438.3 |

|

| 3 |

| |

Outdoors |

| 61.6 |

|

| 54.3 |

|

| 13 |

|

|

| 162.8 |

|

| 131.0 |

|

| 24 |

| |

Security |

| 34.3 |

|

| 34.7 |

|

| (1 | ) |

|

| 97.3 |

|

| 83.2 |

|

| 17 |

| |

Corporate expenses |

| (36.4 | ) |

| (35.4 | ) |

| 3 |

|

|

| (112.2 | ) |

| (98.1 | ) |

| 14 |

| |

Total operating income before charges/gains (a) | $ | 215.9 |

| $ | 219.9 |

|

| (2 | ) |

| $ | 599.1 |

| $ | 554.4 |

|

| 8 |

| |

(1) | Restructuring charges, which include costs incurred for significant cost reduction initiatives and workforce reduction costs by segment, totaled | |

(2) | Other charges/gains represent costs that are directly related to restructuring initiatives but cannot be reported as restructuring costs under GAAP. These costs can include losses from disposing of inventories, trade receivables allowances from discontinued product lines, accelerated depreciation due to the closure of facilities, and gains or losses from selling previously closed facilities. During the thirteen weeks and thirty-nine weeks ended |

(a) (d) (e) (f) For definitions of Non-GAAP measures, see Definitions of Terms page

FORTUNE BRANDS INNOVATIONS, INC. OPERATING MARGIN TO OPERATING MARGIN BEFORE CHARGES/GAINS (Unaudited) | ||||

|

| Thirteen Weeks Ended |

| |

|

| Change | ||

WATER |

|

|

|

|

Operating margin |

| 23.8% | 23.9% | (10) bps |

Restructuring charges |

| 0.5% | - |

|

Other charges/(gains) |

|

|

|

|

Cost of products sold |

| 0.3% | - |

|

Amortization of inventory step-up (f) |

| - | 0.3% |

|

Operating margin before charges/gains |

| 24.6% | 24.2% | 40 bps |

|

|

|

|

|

OUTDOORS |

|

|

|

|

Operating margin |

| 16.9% | 14.2% | 270 bps |

Restructuring charges |

| 0.7% | - |

|

Other charges/(gains) |

|

|

|

|

Cost of products sold |

| 0.4% | 0.4% |

|

Solar compensation (e) |

| - | 0.2% |

|

Operating margin before charges/gains |

| 18.0% | 14.8% | 320 bps |

SECURITY |

|

|

|

|

Operating margin |

| 18.6% | 8.2% | 1040 bps |

Restructuring charges |

| 0.5% | 1.8% |

|

Other charges/(gains) |

|

|

|

|

Cost of products sold |

| 0.3% | 2.5% |

|

Amortization of inventory step-up (f) |

| - | 4.3% |

|

Operating margin before charges/gains |

| 19.3% | 16.8% | 250 bps |

|

|

|

|

|

TOTAL COMPANY |

|

|

|

|

Operating margin |

| 17.8% | 15.6% | 220 bps |

Restructuring charges |

| 0.6% | 0.3% |

|

Other charges/(gains) |

|

|

|

|

Cost of products sold |

| 0.3% | 0.4% |

|

Selling, general and administrative expenses |

| - | - |

|

Solar compensation (e) |

| - | 0.1% |

|

ASSA transaction expenses (d) |

| - | 0.1% |

|

Amortization of inventory step-up (f) |

| - | 0.9% |

|

Operating margin before charges/gains |

| 18.7% | 17.4% | 130 bps |

Operating margin is calculated as the operating income in accordance with GAAP, divided by the GAAP net sales. The operating margin before charges/gains is calculated as the operating income, excluding restructuring and other charges/gains, divided by the GAAP net sales. The operating margin before charges/gains is not a measure derived in accordance with GAAP. Management uses this measure to evaluate the returns generated by the Company and its business segments. Management believes that this measure provides investors with helpful supplemental information about the Company's underlying performance from period to period. However, this measure may not be consistent with similar measures presented by other companies.

(d) (e) (f) For definitions of Non-GAAP measures, see Definitions of Terms page

FORTUNE BRANDS INNOVATIONS, INC. RECONCILIATION OF GAAP NET SALES TO ORGANIC NET SALES EXCLUDING THE IMPACT OF ACQUISITIONS (Unaudited) | ||||||||

|

| Thirteen Weeks Ended |

| |||||

|

| % Change | ||||||

|

|

|

|

|

|

| ||

WATER |

|

|

|

|

|

| ||

Net sales (GAAP) |

| $ | 635.1 |

| $ | 688.0 |

| (8%) |

Impact of SpringWell Acquisition |

|

| 5.5 |

|

| - |

|

|

Impact of Emtek and Schaub Acquisition |

|

| - |

|

| 9.1 |

|

|

Organic net sales excluding impact of acquisitions |

| $ | 629.6 |

| $ | 678.9 |

| (7%) |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

OUTDOORS |

|

|

|

|

|

| ||

Net sales (GAAP) |

| $ | 342.7 |

| $ | 366.4 |

| (6%) |

Organic net sales |

| $ | 342.7 |

| $ | 366.4 |

| (6%) |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

SECURITY |

|

|

|

|

|

| ||

Net sales (GAAP) |

| $ | 177.5 |

| $ | 206.8 |

| (14%) |

Impact of |

|

| - |

|

| 5.6 |

|

|

Organic net sales excluding impact of acquisition |

| $ | 177.5 |

| $ | 201.2 |

| (12%) |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

TOTAL COMPANY |

|

|

|

|

|

| ||

Net sales (GAAP) |

| $ | 1,155.3 |

| $ | 1,261.2 |

| (8%) |

Impact of SpringWell Acquisition |

|

| 5.5 |

|

| - |

|

|

Impact of Emtek and Schaub Acquisition |

|

| - |

|

| 9.1 |

|

|

Impact of |

|

| - |

|

| 5.6 |

|

|

Organic net sales excluding impact of acquisitions |

| $ | 1,149.8 |

| $ | 1,246.5 |

| (8%) |

Reconciliation of GAAP net sales to organic net sales excluding the impact of acquisitions on net sales is net sales derived in accordance with GAAP excluding the impact of the acquisition of SpringWell in our Water segment on net sales, and the impact of the stub period revenue that was derived during the thirteen weeks ended

FORTUNE BRANDS INNOVATIONS, INC. RECONCILIATION OF GAAP NET SALES TO ORGANIC NET SALES EXCLUDING THE IMPACT OF ACQUISITIONS AND (Unaudited) | ||

|

| Thirteen Weeks Ended |

|

| % Change |

|

|

|

Water |

|

|

Percentage change in net sales (GAAP) |

| (8%) |

Impact of acquisitions |

| 1% |

Organic net sales excluding impact of acquisitions |

| (7%) |

Excluding China sales |

| 5% |

Organic net sales excluding impact of acquisitions and China |

| (2%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Thirteen Weeks Ended |

|

| % Change |

|

|

|

|

| |

Percentage change in net sales (GAAP) |

| (8%) |

Impact of acquisitions |

| (0%) |

Organic net sales excluding impact of acquisitions |

| (8%) |

Excluding China sales |

| 3% |

Organic net sales excluding impact of acquisitions and China |

| (5%) |

Net sales excluding the impact of acquisitions and the impact of China sales is net sales derived in accordance with GAAP excluding impact of acquisitions and the impact of China sales. Management uses this measure to evaluate the overall performance of its segments and believes this measure provides investors with helpful supplemental information regarding the underlying performance of the segment from period to period. This measure may be inconsistent with similar measures presented by other companies.

Definitions of Terms: Non-GAAP Measures

(a) Operating income (loss) before charges/gains is calculated as operating income derived in accordance with GAAP, excluding restructuring and other charges/gains. Operating income (loss) before charges/gains is a measure not derived in accordance with GAAP. Management uses this measure to evaluate the returns generated by the Company and its business segments. Management believes this measure provides investors with helpful supplemental information regarding the underlying performance of the Company from period to period. This measure may be inconsistent with similar measures presented by other companies.

(b) Diluted earnings per share from continuing operations before charges/gains is calculated as income from continuing operations on a diluted per-share basis, excluding restructuring and other charges/gains. This measure is not in accordance with GAAP. Management uses this measure to evaluate the Company's overall performance and believes it provides investors with helpful supplemental information about the Company's underlying performance from period to period. However, this measure may not be consistent with similar measures presented by other companies.

(c) EBITDA before charges/gains is calculated as income from continuing operations, net of tax in accordance with GAAP, excluding depreciation, amortization of intangible assets, restructuring and other charges/gains, interest expense and income taxes. EBITDA before charges/gains is a measure not derived in accordance with GAAP. Management uses this measure to assess returns generated by the Company. Management believes this measure provides investors with helpful supplemental information about the Company's ability to fund internal growth, make acquisitions and repay debt and related interest. This measure may be inconsistent with similar measures presented by other companies.

(d) At Corporate, other charges also include expenditures of

(e) In Outdoors, other charges include charges for compensation arrangement with the former owner of Solar classified in selling, general and administrative expenses of

(f) For the thirteen weeks ended

(g) Asset impairment charges for the thirteen weeks ended

Additional Information:

For certain forward-looking non-GAAP measures (as used in this press release, operating margin before charges/gains, EPS before charges/gains and cash conversion), the Company is unable to provide a reconciliation to the most comparable GAAP financial measure because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing and/or amount of various items that have not yet occurred, including the high variability and low visibility with respect to gains and losses associated with our defined benefit plans, which are excluded from our diluted EPS before charges/gains and cash conversion, and restructuring and other charges, which are excluded from our operating margin before charges/gains, diluted EPS before charges/gains and cash conversion. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241106609422/en/

INVESTOR AND MEDIA CONTACT:

847-484-4211

Investor.Questions@fbin.com

Source: