DEERFIELD, Ill.--(BUSINESS WIRE)--Aug. 23, 2018--

Fortune Brands Home & Security, Inc. (NYSE: FBHS), an industry-leading

home and security products company, today announced it has signed an

agreement to acquire Fiberon, LLC, a leading manufacturer of outdoor

performance materials used primarily in decking, railing and fencing

products. Fiberon will join Fortune Brands’ new Doors & Security segment

on closing and has agreed to be acquired for approximately $470 million.

“The acquisition of Fiberon provides exciting category expansion and

product extension opportunities for our Doors & Security segment into

the outdoor living space— one of the fastest growing areas of the home,”

said Chris Klein, chief executive officer, Fortune Brands. “Fiberon

brings leadership in performance materials sustainably made in the

U.S.A. from recycled materials. Similar to Therma-Tru’s leadership in

advanced material doors, Fiberon has built its business in the most

attractive segment of the decking category– non-wood, capped composites.”

The $2.5 billion decking market is a critical part of outdoor living

spaces with growing conversion to non-wood materials. Capped composite

non-wood products where Fiberon has focused its business are growing at

nearly 10% annually and now represent approximately one quarter of the

decking market. This exceptional growth is driven by demand for

innovations in finishes, textures, colors and styles coupled with low

maintenance and lasting durability versus traditional wood.

“Our Doors & Security platform has the scale and capabilities to further

Fiberon’s penetration of the market across our existing customers and

distribution channels in this growing market segment,” said Klein. “Our

execution and momentum within our Therma-Tru door brand coupled with

Fiberon’s successful business model and product line create an exciting

opportunity to accelerate growth and value creation. The acquisition is

expected to be accretive to earnings by approximately 5-6 cents in 2019

and approximately 9-10 cents in 2020.”

“Fortune Brands’ strong distribution, commitment to brands, innovation

and design, and superior execution are a powerful combination to drive

sales and profit growth,” said Doug Mancosh, chief executive officer and

president, Fiberon. “We are excited to join Fortune Brands and create

new opportunities for Fiberon to thrive.”

In 2017, Fiberon had approximately $200 million in annual sales. Fiberon

has approximately 475 associates with offices and operations in

Meridian, Idaho and New London, North Carolina. The Company plans for

Fiberon to operate as a part of the Doors & Security segment.

The closing of the transaction is subject to regulatory approval and is

expected to occur within the next 30 days.

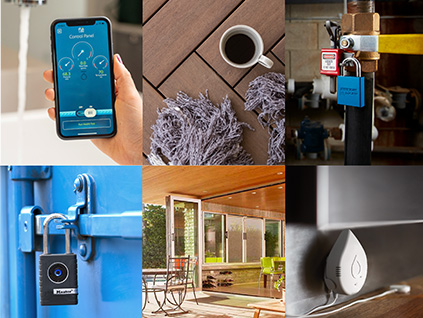

About Fortune Brands

Fortune Brands Home & Security, Inc. (NYSE: FBHS), headquartered in

Deerfield, Ill., creates products and services that fulfill the dreams

of homeowners and help people feel more secure. The Company's operating

segments are Plumbing, Cabinets and Doors & Security. Its trusted brands

include Moen, Perrin & Rowe, Riobel, Rohl, Shaws and Victoria + Albert

under the Global Plumbing Group (GPG); more than a dozen core brands

under MasterBrand Cabinets; Therma-Tru entry door systems; and Master

Lock and SentrySafe security products under The Master Lock Company.

Fortune Brands holds market leadership positions in all of its segments.

Fortune Brands is part of the S&P 500 Index. For more information,

please visit www.FBHS.com.

Cautionary Statement Concerning Forward-Looking

Statements

This release contains certain “forward-looking statements” regarding

future financial performance and the effects of the Fiberon acquisition.

Where, in any forward-looking statement, we express an expectation or

belief as to future results or events, such expectation or belief is

based on the current plans and expectations of our management. Although

we believe that these statements are based on reasonable assumptions,

they are subject to numerous factors, risks and uncertainties that could

cause actual outcomes and results to be materially different from those

indicated in such statements including the factors discussed in Item 1A

of the Fortune Brands Home & Security, Inc. Annual Report on Form 10-K

for the year ended December 31, 2017, filed with the Securities and

Exchange Commission. In addition, this release contains forward-looking

statements that involve risks and uncertainties associated with the

acquisition. These include: the satisfaction of closing conditions for

the transaction, market conditions and the impact of any failure to

complete the transaction. The forward-looking statements included in

this release are made as of the date hereof, and except as required by

law, we undertake no obligation to update, amend or clarify any

forward-looking statements to reflect events, new information or

circumstances occurring after the date hereof.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180823005659/en/

Source: Fortune Brands Home & Security, Inc.

Fortune Brands Home & Security, Inc.

INVESTOR and MEDIA CONTACT:

Kaveh

Bakhtiari

847-484-4573

kaveh.bakhtiari@FBHS.com