Fortune Brands Board of Directors Approves Separation of MasterBrand, Inc.

Separation expected to be complete on

The separation is expected to be complete on

The distribution does not require stockholder approval and no stockholder action is necessary to receive shares in the distribution of MasterBrand’s common stock. Fortune Brands will distribute an information statement to all stockholders entitled to receive the distribution of MasterBrand’s shares. The preliminary information statement has been included as an exhibit to MasterBrand’s Registration Statement on Form 10 filed with the

Fortune Brands expects that a “when-issued” public trading market for MasterBrand’s common stock will commence on or about

Beginning on or about

Leadership from Fortune Brands and MasterBrand will speak to their respective strategies at the Company’s upcoming Investor Day on

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking statements” that are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding general business strategies, product offerings, expansion into new geographic markets, market potential, anticipated future financial performance, the potential of our brands, and other matters. Statements preceded by, followed by or that otherwise include the words “believes”, “positioned”, “expects”, “estimates”, “plans”, “look to”, “outlook”, “intend”, and similar expressions or future or conditional verbs such as “will”, “should”, “would”, “may” and “could” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our management. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements, including but not limited to the expected benefits and costs of the intended spin-off transaction; the tax-free nature of the spin-off; the expected timing of the completion of the spin-off transaction and the transaction terms; general business and economic conditions; our reliance on the North American repair and remodel and new home construction activity levels; our reliance on key customers and suppliers; our ability to maintain our strong brands and to develop innovative products while maintaining our competitive positions; our ability to improve organizational productivity and global supply chain efficiency; our ability to obtain raw materials and finished goods in a timely and cost-effective manner; the impact of sustained inflation, including global commodity and energy availability and price volatility; the impact of trade-related tariffs and risks with uncertain trade environments or changes in government and industry regulatory standards; our ability to attract and retain qualified personnel and other labor constraints; the uncertainties relating to the impact of COVID-19 on the Company’s business and results; our ability to achieve the anticipated benefits of our strategic initiatives; our ability to successfully execute our acquisition strategy and integrate businesses that we have and may acquire; and the other factors discussed in our securities filings, including in Item 1A of our Annual Report on Form 10-K for the year ended

About Fortune Brands

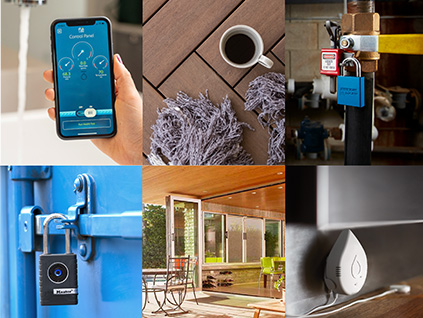

The Company’s growing portfolio of complementary businesses and innovative brands includes Moen and the

View source version on businesswire.com: https://www.businesswire.com/news/home/20221122005285/en/

INVESTOR CONTACT:

Investor.Questions@fbhs.com

MEDIA CONTACT:

Media.Relations@fbhs.com

Source: